In the quaint corners of Coulsdon, Purley, and Chipstead, whispers of a financial lifeline echo among those in their late 30s to late 40s. They're eyeing the potential inheritance from their baby boomer parents as a golden ticket to home ownership and retirement serenity.

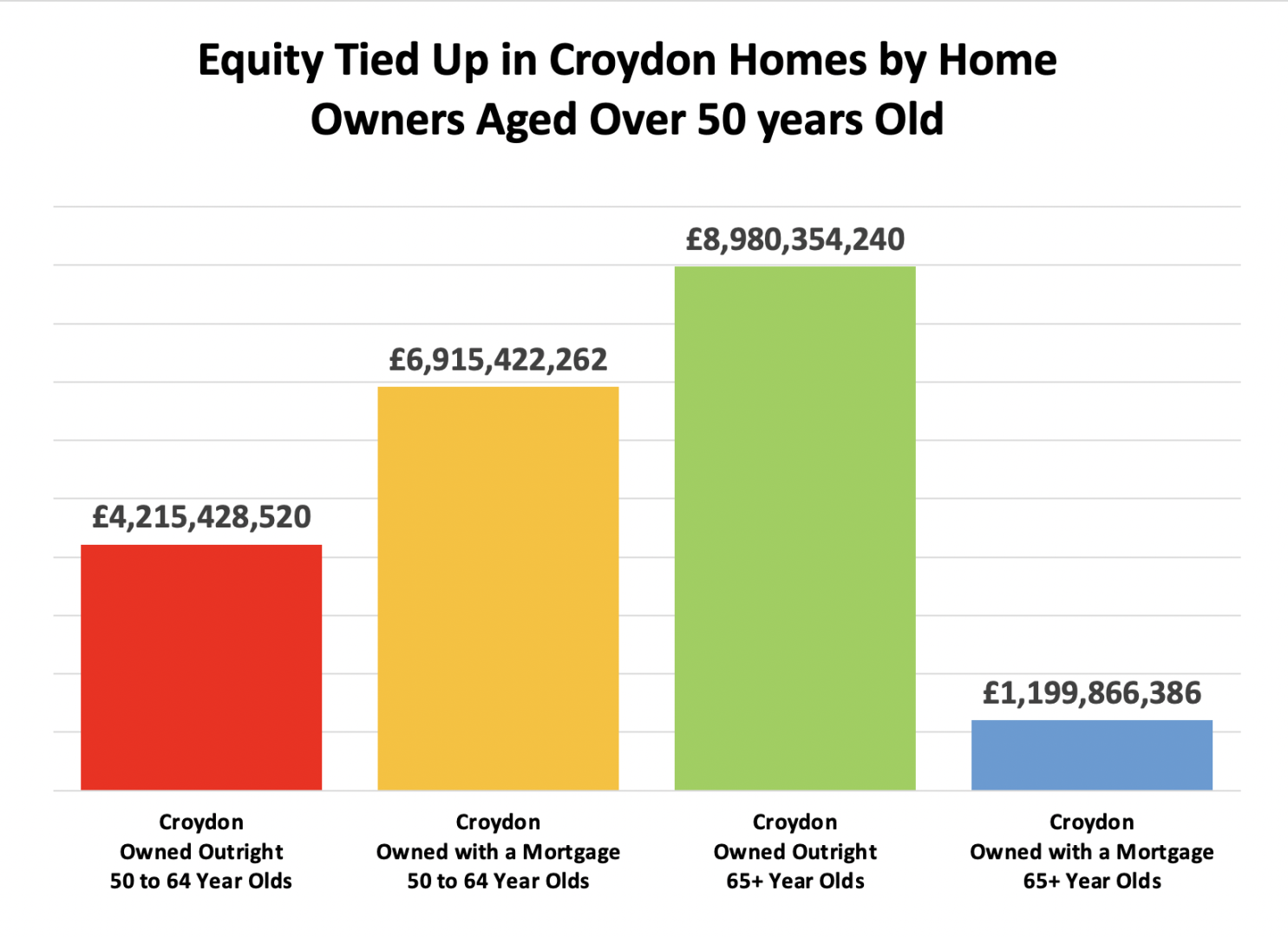

Picture this: a staggering £2 trillion snugly nestled in the bricks and mortar of the UK's senior citizens, with an additional £2 to £3 trillion dancing in the realm of stocks, shares, and property investments. This colossal sum, estimated to be between £4 to £5 trillion, is poised for a graceful handover from the baby boomers to the waiting arms of both Generation X and, to a lesser extent, Millennials.

It's a financial tango already underway, set to reshape the economic dance floor for the younger generations, offering a glimmer of hope amidst the stormy seas of financial uncertainty.

But before we paint too rosy a picture, let's pause to acknowledge the shadows lurking in this windfall. A significant slice of this inheritance pie will likely swirl within the already affluent circles of property-owning families, underscoring the stark reality of wealth disparity that shadows our economic landscape.

And there's more. The looming silhouette of healthcare costs for our aging baby boomer population casts a long shadow over this financial inheritance tale. With the average weekly costs of care homes and nursing facilities reaching eye-watering heights, the specter of depleting savings threatens to diminish the legacy intended for the next generation.

The dreams of bequeathing a hefty inheritance hang in the balance as healthcare expenses threaten to devour a substantial portion of accumulated wealth.

The challenges facing Coulsdon, Purley, and Chipstead's Gen X and Millennials are not to be underestimated. From the weight of student loans to the volatility of the job market, they navigate treacherous waters in search of financial stability.

While the promise of generational wealth transfer tantalizes, it's essential to recognize the complexities at play. Wealth inequality, soaring care costs, and systemic economic barriers demand a comprehensive approach to fostering financial security and equity across generations.

As we stand at this crossroads of history, let's engage in meaningful dialogue and policy-making. Let's ensure a future that's not just prosperous, but equitable for all.

And to you, older Millennials and Generation Y-ers, fear not. An additional £3.4 trillion in equity awaits your grasp, courtesy of the Gen X-ers. The baton of wealth is passing, but let's not forget the responsibility that comes with it.

For in the end, every generation must shoulder its own burden and carve its own path towards a secure and prosperous future.

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link